Agglomerators vs. Specialists

The great battle of the venture capital industry.

Welcome to issue #10 of next big thing.

On one side of the venture capital industry are the agglomerator firms. They invest at every stage, across every sector, and many are growing even larger.

On the other side are the specialist firms, either by sector, or by stage, or both.

The industry has bifurcated, and there are several implications for its future.

In 2010, Chris Dixon wrote a short piece on the segmentation of the venture capital industry. He described the increasing segmentation by stage, where it had previously been segmented by sector, and the framing of venture capital as a product:

Mentorship and angel funding are performed more effectively by specialized firms. Entrepreneurs seem to realize this and prefer these specialized “products.”

A decade later, as capital has flooded into the ecosystem, there is a clear bifurcation in venture firms and their products.

On one side are the agglomerator firms. They invest at every stage, across every sector, and they are becoming larger in fund sizes and in teams. They offer many different products to both founders and limited partners (LPs) under one roof.

[Agglomerate means to gather in a cluster or mass. A big thank you to my friend Kanyi Maqubela for coining the term agglomerator in our text exchange. Other potential options to name this set of firms: aggregators, bulge brackets, megafunds, platforms.]

On the other side are the specialist firms, either by sector, or by stage, or both. They offer specialized products to founders and to LPs.

The competition to make the best investments is between the agglomerators and the specialists, and also amongst firms within each category.

This essay is an attempt to define these groups, and to offer 10 implications for the future of the venture capital industry that result from this battle.

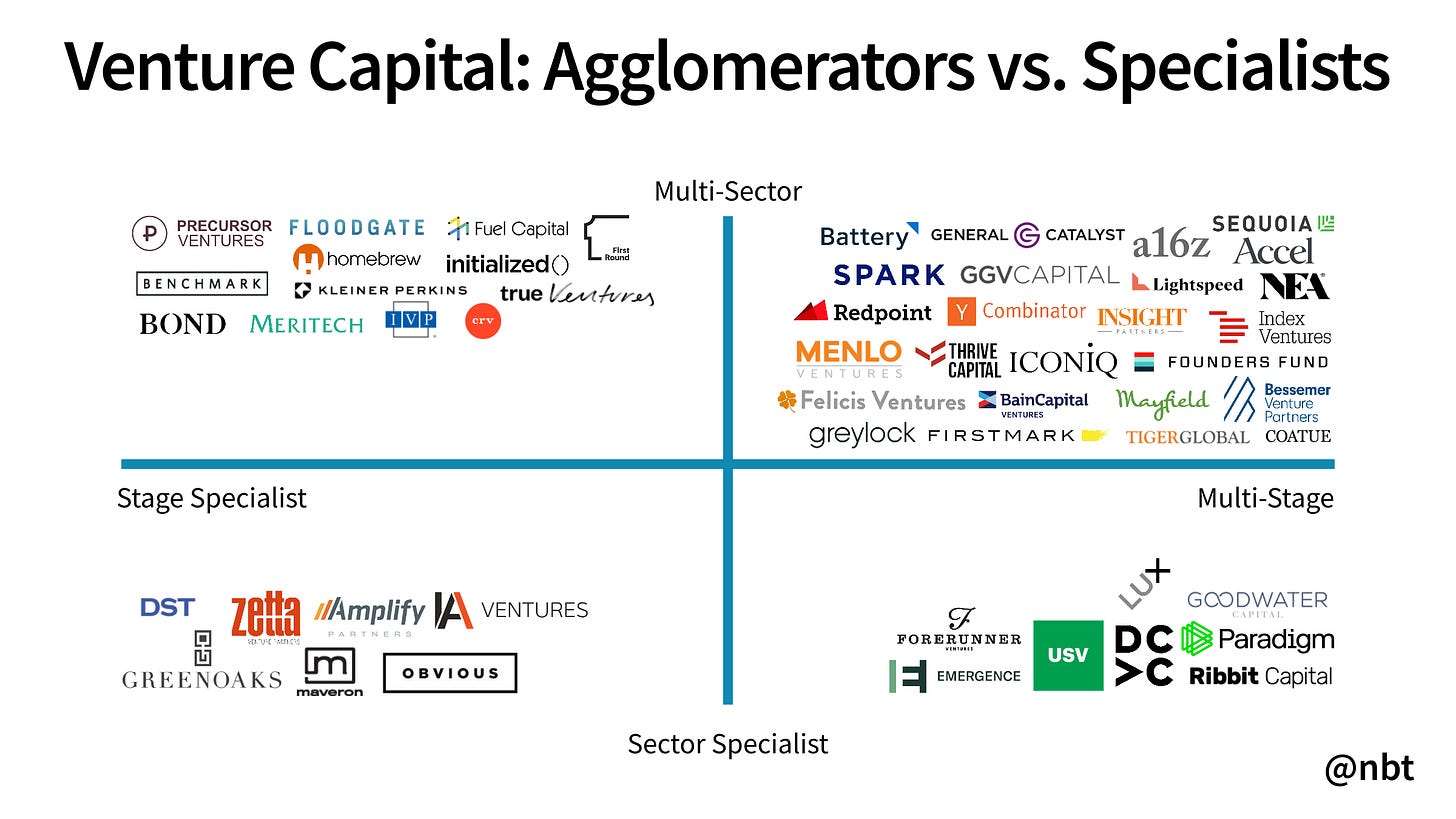

This graph, created in July 2020, illustrates the segmentation of venture capital firms into agglomerators (top right quadrant) and specialists (the other three quadrants). The list of firms is by no means comprehensive. The placement of some firms is challenging, and I’m sure several firms will disagree with my characterization of where they sit.

The Agglomerators

The top right quadrant in the above graph represents the agglomerators. These firms invest across stages and sectors.

It's a group of around 25 firms today. Accel, Andreessen Horowitz, Bessemer Venture Partners, Founders Fund, Index Ventures, NEA, and Sequoia Capital have long occupied seats in the agglomerator club. General Catalyst and Lightspeed have aggressively grown from being early-stage specialists in the not-too-distant past to firmly being agglomerators today. Firms such as ICONIQ Capital and Insight Partners started as late stage investors, but have invested at earlier stages over the years. Coatue Management and Tiger Global are public investors that have also developed growth- and early-stage venture products. Y Combinator may be a controversial addition to this group, for it is most well known for its accelerator program. But through YC Continuity, it has a fund to invest at the later stage, and is an important player across fundraising rounds with programs such as YC Series A and YC Growth.

How did these firms become agglomerators? Most started off as specialists but, as they generated strong returns, they had the license to become agglomerators. LPs supported the broadening of their products, with the firms increasing their fund sizes, teams, and investment scopes.

Here are some of the characteristics of agglomerators:

Large Fund Sizes: most of the agglomerators have fund sizes north of $1 billion, and certainly have assets under management in the billions (if not tens of billions) of dollars.

Large Teams: the investment teams of the agglomerators are almost all above 10 people in size, with many of the firms being over 100 employees. The investment teams include sector- and stage-specialist partners.

Multiple Funds: many of the agglomerators have different funds for different sectors, stages, or geographies. It's helpful to think of these as products. Agglomerators can offer seed-stage products, early-stage products, growth-stage products, healthcare/crypto/biology products, US/Europe/India/China/ROW products, and more. A few of the firms have one team that spans across multiple funds, but most of the firms have dedicated teams to dedicated funds.

Multi-Geography: many of these firms, such as Accel, GGV Capital, Index Ventures, Lightspeed, Mayfield, and Sequoia Capital, invest across geographies, with offices on multiple continents. Some invest across geographies with a single team in a single location, such as Felicis Ventures, Insight Partners, and Thrive Capital.

Portfolio Services: most, if not all, of the agglomerators, have a dedicated team focused on helping portfolio companies. Many of the specialists offer these services, too, but it's almost mandatory for the agglomerators to offer them. These services include support on recruiting, marketing, and business development. The agglomerators can afford to invest in these services because of their scale, and higher annual budgets through management fees on larger funds.

Zero-Sum: because of their larger fund sizes, and multiple products, it is harder for the agglomerators to be collaborative in the ecosystem. They need as much ownership as possible to generate the highest returns, and they can get that ownership by investing in companies at every stage. Most of the agglomerators are therefore zero-sum players in the ecosystem.

The Specialists

The other three quadrants consist of firms that are specialists.

These include firms that are both stage- and sector-specialists, such as Maveron in early-stage consumer, and Greenoaks Capital and DST Global in late-stage consumer. There are sector specialists that are increasingly multi-stage, such as Emergence Capital in SaaS and Ribbit Capital in fintech. And the largest bucket of specialists invest across sectors, but focus on a stage, such as Precursor Ventures in pre-seed, First Round in seed, Benchmark and Kleiner Perkins at the Series A/B, and Meritech and IVP in growth.

Here are some of the characteristics of specialists:

Stage-Sized Funds: seed-focused specialists mostly have funds that are under $250 million in size, growth-focused specialists have funds that are above $500 million, and the multi-stage sector-specialized funds tend to be on the larger side, with separate funds for separate stages (a similarity with the agglomerators).

Small Teams: most of the specialist firms have investment teams that are under 10 people, and firms that are under 50 people.

Opportunistic on Geography: most of the specialist firms in the U.S. focus on investing in the U.S., but a few are opportunistic about investing internationally, with the same core team. Multiple geographic funds or separate investment teams for other geographies isn't a characteristic of specialists.

New Firms: most new venture capital firms start out as specialists. Because it's harder to stand out in today's industry, and because most first-time funds are hard to raise, it's almost a necessity for a new firm to have a focus. A recent exception is Addition, the firm founded by Lee Fixel, which raised $1.3 billion for its first fund, and is an agglomerator from day one.

Collaborative: though some of the specialist firms are zero-sum (Benchmark and the other specialists at the Series A/B typically lead rounds and leave little room for co-investors), many are collaborative. They are willing to co-lead rounds with other investors, or write supporting checks in financings that fit their specialized thesis. Collaboration becomes harder as fund sizes increase, hence why it is not a characteristic of agglomerators.

Focus: the core advantage of the specialists is having a focus. Internally, specialists can focus their teams and processes to best suit the sector or the stage. Externally, the brand of the firm can stand out further in the minds of both founders and LPs by being a specialist and having a focus.

10 Implications for the Future of Venture Capital

Let me take a stab at what this bifurcation may mean for the industry's future.

Being in the Middle is No Man's Land. You can be world class as either an agglomerator or a specialist - Sequoia is the former, Benchmark is the latter. But being in the middle - neither an agglomerator nor a specialist - is very challenging, and may be no man's land in today's environment.

The Next Decade is a Referendum on the Agglomerators. So many firms have gone from being specialists to agglomerators in the past decade, with larger fund sizes and mandates. It remains to be seen whether these firms, and how many of them, will generate top tier returns. Because larger fund sizes have historically correlated with larger round sizes, higher valuations, and lower multiple returns on the fund, the scrutiny is on the agglomerators in the decade ahead.

More Specialists Will Become Agglomerators. For specialist firms that have had success in generating returns, the "easy" path in some ways is to raise more and more capital, develop more products for LPs and for entrepreneurs, and become agglomerators. In the process, these firms can earn more income annually as a partnership with management fees, another attraction to this route. Many specialists will continue to go in this direction.

Several Agglomerators Will Retreat. Kleiner Perkins used to be an agglomerator, but it refocused over the last few years to early-stage, lowered its fund size, and became a specialist. At the turn of the millennium, Benchmark had international-focused funds. Its European fund declared independence in 2007, and Benchmark refocused to be a smaller fund with one U.S.-based team over the past decade. The same retreat will happen for several agglomerators who don't produce quality returns over the next decade, or who choose for strategic reasons to specialize. The reboots won't be graceful, but they will be necessary.

Sector Specialists Will Go Multi-Stage. This trend began over the last decade, with thesis-driven firms like USV raising separate funds for early- and growth-stage investments. Expect to see this continue.

Competition Between Agglomerators and Stage Specialists Will Be Fierce. The agglomerators are more of a competitive threat to the stage specialists than they are to the sector specialists. They can lead seed and Series A rounds with larger checks and at higher valuations, by virtue of their larger fund sizes. However, smaller investments matter less to most agglomerators than they do to most specialists, and specialists have the advantages of focus and speed that can win over founders. Some founders will choose to raise their seed from a seed-focused fund, but some will choose to work with an agglomerator instead, even at the earliest stage.

Many Agglomerators Will Look The Same. A firm’s brand matters, and agglomerators have more resources with which to build their brand than the average specialist does. But one of the challenges of being an agglomerator is standing out from the other agglomerators. These firms are already starting to look like one another, and the competition amongst them is fierce (even more so than between the agglomerators and the stage specialists). This has happened in other parts of financial services; for example, it’s hard to distinguish between many of the investment banks. The commodification of agglomerators presents new opportunities for specialists to differentiate.

Super-Agglomerators? It is likely that a handful of the agglomerators will become even bigger than the rest, as they out-compete others, generate the best returns, and attract more LP dollars. Sequoia is of course the most likely firm to be in this group, and one could argue already is. There is perhaps a parallel here with Ben Thompson’s Aggregation Theory, and the Super-Aggregators that have emerged within the set of aggregators.

Will Collaboration Survive? As the number of agglomerators grows, and with a finite number of outsized-return generating companies every year (even though those outcomes are getting bigger!), the industry looks to be becoming more zero-sum. This may not be in the best interest of founders, who can benefit from working with multiple firms if they are willing to collaborate on a financing.

New Forms of Specialists Will Emerge. The past decade saw new firms like Andreessen Horowitz change the industry, and Y Combinator leverage its network effects to become an agglomerator. It will be fascinating to see what emerges over the next decade that changes the fundraising landscape. Solo capitalists could be one part of the story. What will be the others?

This framing of agglomerators vs. specialists analyzes the venture ecosystem through a structural lens. But ultimately, venture capital remains a people-driven business. It’s the venture capitalists who create the products, and often are the product themselves in the eyes of founders. And it’s the desires of founders that drive venture firms to change. I’ll discuss the human aspects of the industry, and how they are evolving, in my next post.

Thank you to Alex Taussig, Kanyi Maqubela, Laura Thompson, Rebecca Kaden, Semil Shah, Tripp Jones, and Will Quist for your thoughtful feedback on drafts of this essay.

This is a great post Nikhil - I think another force driving specialization in the VC model is the rise of strategic LPs who bring differentiation to GPs. Google has created a family of funds (GV, Capital G, and Gradient) that represent sector specialization and stage specialization. Sapphire (SAP) and M12 (Microsoft) have also emerged as relevant sector specialists and stage specialists in the ecosystem in a short period of time. Our firm, Decibel (Cisco), is purely focused on B2B software at the earliest stage and is investing heavily in services to help founders. The VC industry is now >50 years old - I think all of the innovation going forward is not in how we invest in companies but in how we differentiate what we do to help startups grow.

Thanks for sharing your thoughts. Another way to evaluate the specialist to agglomerator migration as well as the emergence of microfunds at the seed stage is through the lens of Christensen's Disruption Theory. The desire and need for growth (represented by growth in AuM) drives this migration and is difficult to resist. The same argument can be made for the angel -> super angels -> SPVs migration that you mentioned in the previous post. One way to address this urge for AuM growth is to limit growth in team size which makes it easier to stay a specialist without worrying about how to meet the team's career progression needs. And if you do go the agglomerator route, you can remain competitive (and generate great returns) if you 1. align incentives across both the investment and portfolio support team in a way that each sub-fund can invest and support portfolio companies independent of the other funds and 2. make sure that the value you provide to the entrepreneurs who take the smaller checks get the level of support they expect from a strong brand in the market. Obviously, all these suggestions are easy to recommend and difficult to execute on so it will be interesting to see how the market evolves.