Grocery Delivery and The Future of Packaged Food

What will happen to consumer behavior post-pandemic?

Welcome to issue #15 of next big thing.

I wrote about food delivery a couple weeks ago with a focus on the future of the restaurant industry.

Roughly 50% of U.S. spend on food and beverage happens at restaurants, but the other 50% is at grocery stores.

One of the biggest increases in spend since the start of the pandemic has been in grocery, with online grocery delivery services benefitting in particular.

Instacart has emerged as a winner so far. But could there be others?

And then there's the multi-billion dollar question: what will consumer behavior in grocery look like post-pandemic?

Grocery is having a moment

I began writing this essay back in March. We were stocking up our home with groceries - all credit goes to my wife Chandrika, who started worrying about the possibility of lockdowns in February - and I was thinking about the shifts in our own behavior, and how that might translate to the broader market.

We now know that grocery spend increased dramatically in the U.S. following the declaration of the covid-19 pandemic. In March 2020, spending at U.S. grocery stores jumped by 26%. While spending at restaurants and bars had marginally eclipsed that of spending at grocery stores for the past few years, 63% of food and drink was purchased at grocery stores in March, the highest % share since 1996.

The increase in grocery spend continued in Q2 2020. Analysis by Second Measure* found that quarterly spend on groceries grew to nearly $400 in Q2, up 31% year-over-year. Of course, the increase in grocery spending makes sense for four reasons:

Many restaurants were forced to close due to shelter-in-place orders, making grocery the main option to get food.

Many people (like us!) stocked up on groceries in case restrictions became even more severe and limited access to food.

More time working from home means more time snacking and eating meals at home, and more groceries needed for that.

Because of consumers' worries around the health risks of stepping outside, or into a grocery store or restaurant, they turned to delivery services, including grocery delivery.

Before the pandemic, only 3.2% of food and beverage spending was online, according to eMarketer data from February 2020. This is the lowest online penetration of total retail sales for any of the product categories in the chart below.

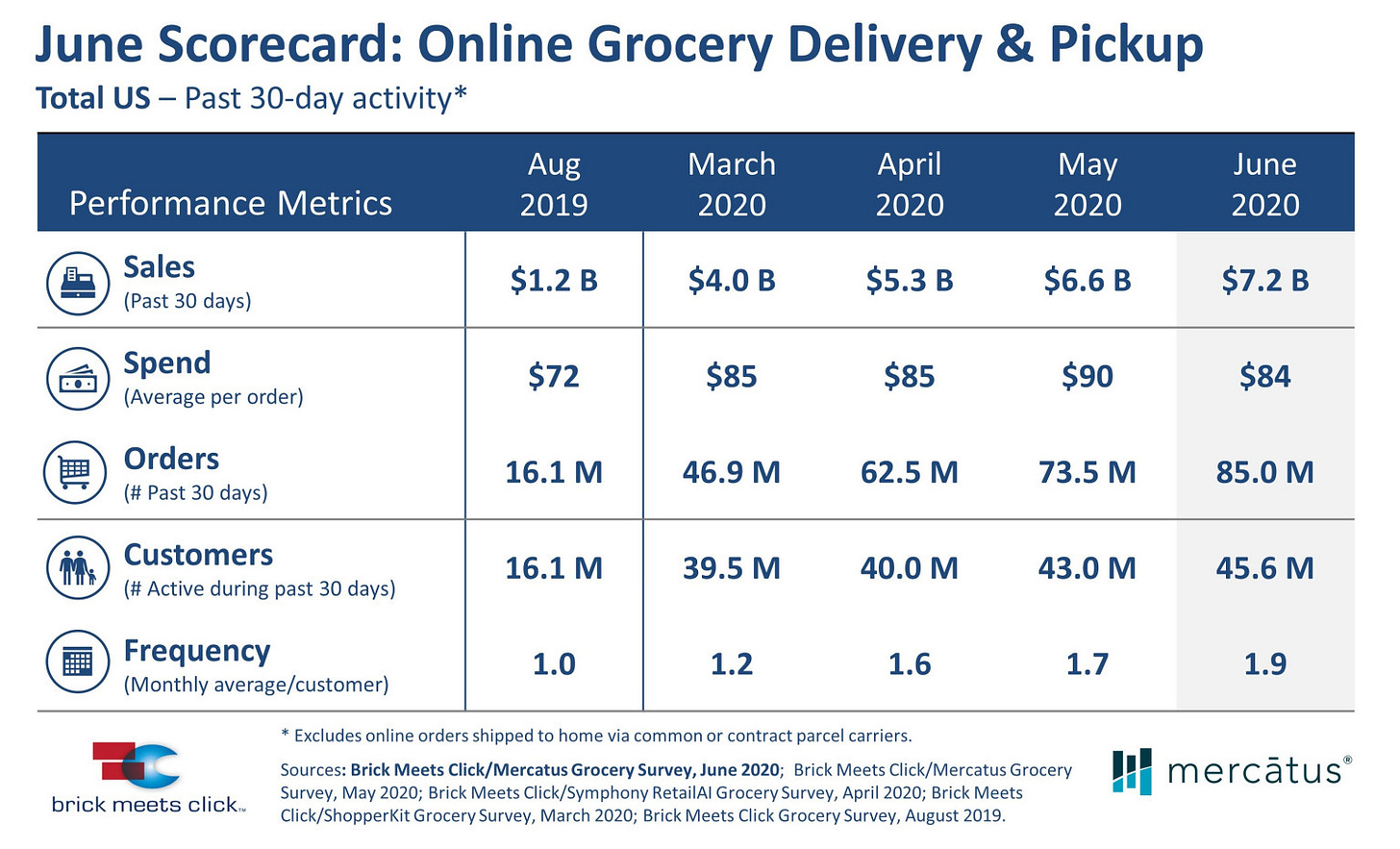

The numbers for online grocery delivery and pickup post-pandemic are staggering. While the data from February 2020 predicted $32.2 billion in eCommerce food and beverage spend this year, research from Brick Meets Click and Mercatus found that sales hit $7.2 billion in June 2020 alone. 45.6 million households used grocery pickup and delivery services that month, up from 16.1 million in August 2019.

And U.S. customers have gone from using online grocery once a month to almost twice a month. This is a fundamental behavior shift that has unfolded in a very short period of time.

Instacart is the big delivery winner so far

Which services are consumers using? According to Second Measure, Instacart has been the key beneficiary of all the grocery delivery players in the past several months.

Instacart's market share has eclipsed that of Walmart Grocery, which had been the market leader prior to the pandemic.

Instacart is a multi-sided marketplace. The company partners with national and local grocers to enable consumers to get items delivered from those stores. The company also partners with shoppers, who are either part-time employees or contractors, and who fulfill orders by getting items from a store, and delivering them to customers.

Walmart Grocery and Amazon* have direct, full stack models for grocery delivery, leveraging their physical stores (Whole Foods in the case of Amazon). Shipt is owned by Target but also offers deliveries from partners through an Instacart-like model. Uber recently launched grocery delivery in partnership with Cornershop, another marketplace.

There are also online-only, vertically-integrated grocery delivery businesses, such as Imperfect Foods*, which offers a subscription for groceries at a discount to in-store prices, and Weee!, a specialty online grocery delivery service for Asian grocery items. There are platforms like Dumpling, which enable people to create their own grocery delivery businesses. Think of it as a Shopify*-like model, versus the aggregator, Amazon-style model of Instacart. Dumpling, Imperfect, and Weee! have all raised new rounds of financing during the pandemic. Finally, the meal kit services such as HelloFresh, Sun Basket, and BlueApron also serve as replacements to grocery store trips. Wirecutter has a nice rundown of many of the aforementioned grocery services as well as others geared towards shopping during the pandemic.

The traditional grocery industry is quite fragmented in the U.S. Kroger has the highest market share, followed by Albertson's. Trader Joe's and Whole Foods each have about 5% market share. Most people have a primary grocery store that they go to every week, supplemented by secondary and tertiary stores. Think about your own consumer behavior; my bet is that you shop at multiple grocers. The brilliance of Instacart is that it has aggregated grocers, as well as shopping and delivery personnel, on one platform. But if online grocery continues to grow, it could one day be over $100 billion in annual sales in the U.S., meaning that even 1% market share can lead to a $1 billion revenue business.

What will happen post-pandemic?

The unknown for everyone involved in the grocery delivery industry is what consumer behavior will look like when we are back to normal, without masks and shelter-in-place restrictions. Will online grocery ordering and delivery remain a habit for many consumers? Or will most go back to stores the way they once did?

My guess is that, though many customers will return to their pre-pandemic grocery shopping, a significant portion will continue with the online grocery habits they've developed during this time. After a year or more of the new habits of meal planning, grocery lists, fulfillment through online services, and more that many consumers are currently under-taking, it will be hard to return to old ways.

What we've seen in eCommerce over the years is that it has kept growing, with particular growth during Q4 holiday seasons leading to consumers permanently shifting to online buying during subsequent years. Andrew Lipsman summarizes the online grocery shift well in this piece, with the following conclusion:

If households that had previously used ecommerce for just one out of every 10 grocery trips were to permanently shift to one out of every five, the long-term impact would be profound. When looking at total US retail sales, food and beverage is a $1 trillion category. If the ecommerce category penetration went from 3.2% to 5.2% over the next couple of years, that’s about $20 billion moving online.

There are also data points internationally, as the surge in online grocery customers is not just an American phenomenon. Online grocery sales have doubled in the U.K. since covid-19. China also saw surges in online grocery with consumers gravitating towards tech-savvy supermarkets during the height of the pandemic. And the Chinese market has much higher penetration in both eCommerce and online grocery than the U.S.

Furthermore, if office centricity is over, and work from home becomes permanent for more people, those extra grocery purchases due to lack of snacking and eating at the office will remain as well.

Not only does this trend have implications for founders and investors in the grocery category, but it also affects those in the CPG industry focused on packaged food. Grocery retail channels have shifted in a matter of months, and may shift even more profoundly in the coming decade. Small grocery stores, in particular, will find it challenging to survive in a technology-driven grocery world.

The next Beyond Meat or RxBar may not gain a following by selling through traditional grocery. Instead, it's more likely than ever to go direct-to-consumers, via its own website. And perhaps it will leverage the newly expanding online grocery channels to build its brand. Brands are already selling directly through platforms such as Instacart, and Instacart recently launched a self-serve advertising product for brands to promote their products in the app.

It wouldn't surprise me if the next big thing in packaged food begins life outside of traditional grocery stores during this time, and I'm excited to follow innovation here closely in the months and years ahead.

Thank you to Anarghya Vardhana for your feedback on the draft.

I started next big thing to share unfiltered thoughts. I’d love your feedback, questions, and comments!

*denotes a company I'm affiliated with as an investor - see my substack about page.

What about the price aspect of using grocery delivery service like Instacart? InstaCart charges a 23% markup on grocery bills which is a significant amount for average households. During the pandemic it is more of an “essential service” but when things are back to normal it is more of a “luxury service”. The other difference between grocery delivery and other types of e-commerce purchase is that you can typically find price matching items (if not cheaper) when purchasing online even when factoring in the shipping cost (thanks to Amazon). Grocery is a different story due to the low margin so online grocery shopping is more expensive than offline by a significant amount.

Another aspect of grocery delivery retention is encoded in its customer model -- Walmart+, Instacart, Shipt make the most sense for consumer when they are bought on a 12-month subscription. This means that even if there is a vaxx tomorrow, you have a huge number of people who have already crossed the 28-day habit threshold and have paid for another 6 months of service. They'll likely keep using it through that period, which we believe will ultimately mean good retention for these services.

Reilly