Slack-Salesforce and The Next $10B+ Software Acquisition

What it means for the consumerization of enterprise technology, and why Dropbox is next in line.

Welcome to issue #27 of next big thing.

Today’s essay is a follow up to Consumer and Enterprise (#2) from May, which discusses how the most interesting companies in the world are both consumer and enterprise technology businesses.

Salesforce’s* acquisition of Slack* last week for nearly $28 billion is further evidence for the thesis in that piece. The merger sets up a battle for the future of enterprise software between Microsoft* and Salesforce, with several other players also in the mix.

And that brings us to an obvious question: are there more $10+ billion software acquisitions on the horizon? And if so, who are the logical targets? I believe the answer is “yes,” and that one of the most obvious targets is Dropbox*.

The Rationale for Slack-Salesforce

I’ve read and listened to several great takes on Salesforce’s acquisition of Slack. Rather than re-hash all the points here, here are links to my six favorites:

Salesforce Acquires Slack, Salesforce’s Reasoning, Salesforce’s Opportunity by Ben Thompson.

Salesforce, Slack, and the future of work by Aaron Levie.

The Way of the Future: A quick rebuttal on the Slackforce Slacklash by M.G. Siegler.

Quickly Unpacking A Wild Week Of Big Exits – Gainsight, Kustomer, Slack by Semil Shah.

Episode 14 of The All-In Podcast, where David Sacks discusses Slack-Salesforce.

Slack + Salesforce Emergency Pod with Packy McCormick by Acquired FM.

There are two fundamental reasons that this deal makes sense for both companies.

First, Salesforce can solve enterprise distribution for Slack, given its existing sales force and enterprise business that will be over $20 billion in revenue in 2021.

Second, Slack gives Salesforce a bunch of unique assets: a horizontal use case in enterprise (not specific to sales and marketing departments as its other products are), a product and brand that is popular with the latest generation of technology companies, consumer product DNA, and network effects through products such as Slack Connect.

In other words, the first reason is about enterprise distribution, and the second is about consumer product.

These rationales are two sides of the same coin — the coin that is the consumerization of enterprise technology, a trend which has been unfolding for the past decade. Software increasingly spreads bottoms-up in companies, through individual employees adopting products they want to use and getting colleagues to use those products. This adoption ultimately helps lead to a company-level purchase and rollout of the software.

Microsoft (Slack’s main competitor through its Teams product) and Salesforce understand this better than most. They are the leaders in the battle for the future of enterprise software, with Salesforce now having more of an end-to-end suite of products to compete with Microsoft. As Aaron Levie, founder & CEO of Box, states:

This isn't just about the future of “collaboration.” This is a new “operating system” for how knowledge workers will interact in the future, connecting the front office, back office, and customers all together in a single platform.

The Battle for the Future of Enterprise Software

It’s fascinating to consider how this battle has evolved in the past twenty years.

Salesforce has been the pioneer of software-as-a-service (SaaS), the primary delivery model for enterprise software today. It’s built a juggernaut in enterprise through its own innovation as well as its acquisitions. And in the recent past it has been aggressive to bring in consumer technology DNA, through its acquisitions of Quip (founder Bret Taylor was previously CTO at Facebook and is now President and COO at Salesforce), and now Slack. Microsoft has made the opposite evolution, from being the dominant player in consumer software, through Windows and Office, to being the leader in enterprise software today.

Of course, Salesforce and Microsoft are not the only players here. Amazon*, Google*, Facebook* (especially considering its purchase of Kustomer last week), Adobe, Cisco, Oracle, SAP, Zoom*, Atlassian, and more are all on the field for this battle, with Apple and Netflix noticeably the two major technology companies that feel absent.

Hundreds of billions of dollars in market capitalization are at stake for the companies that figure out the shift to the consumerization of enterprise technology over the next decade (or don’t!). The key to adapting is having consumer-grade product with enterprise-level distribution, unless something fundamentally changes about enterprise distribution in the coming decade that enables bottoms-up companies to scale to tens of billions of dollars in revenue.

Slack was supposed to be the poster child for this story, but it was never able to truly fulfill that promise as an independent public company . Perhaps all hope is not lost, however. Look at Canva*, Figma, Airtable, and Notion as examples of consumer software companies with bottoms-up distribution that are scaling quickly in enterprises today.

The Slack-Salesforce acquisition is in some ways the ultimate hedge on the future of enterprise software. If top-down enterprise distribution remains core to success in the enterprise, this is a win for Slack. If bottoms-up distribution can continue to scale in annual contract values (ACVs) and becomes the default way to buy enterprise software in the coming decades, this is a win for Salesforce.

Dropbox is Next

Are there further massive software acquisitions on the horizon? I think so. The stakes in the consumerization of the enterprise are too high for too many companies, especially so after Salesforce’s purchase of Slack.

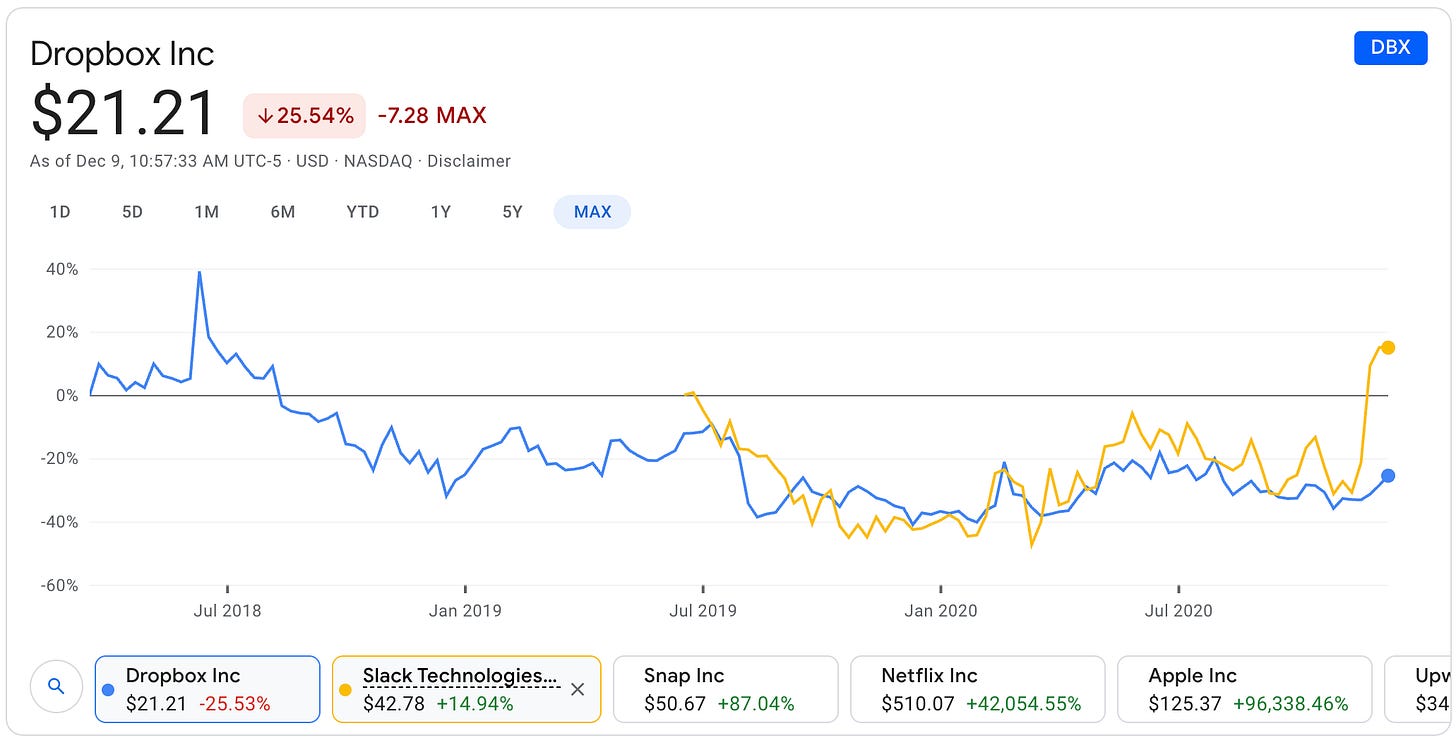

Dropbox strikes me as the most obvious next candidate. The company is a cautionary tale for the current generation’s rising stars, much more so than Slack (which created close to $30 billion in value in just 7 years!). Dropbox was worth $10 billion in the private markets in 2014 and is worth under $9 billion in the public markets today! Its public company trajectory is eerily similar to Slack’s, per the chart above. Both companies have traded below their IPO prices for the majority of their time as public companies, with Slack’s only bouncing above on the Salesforce acquisition announcement.

What’s gone wrong for Dropbox? The company’s growth has slowed, to under 20% annually. It has not truly made the go-to-market leap from consumer to enterprise. Its product has stagnated too. Similar to Slack, it has had increased fierce competition, from Microsoft, Google, Box, and others. And finally, its net revenue retention is below 100%, which is a huge issue given the best-in-class SaaS companies have well above 100% net revenue retention.

Yet, Dropbox is close to $2 billion in annual recurring revenue (ARR), profitable, and valued at under $10 billion. It’s got 15 million paid users, and 600 million registered users. It’s the backbone of a lot of people’s work and productivity stack. And I suspect if one dug beneath the surface on retention, one would find that its revenue retention for businesses and teams is much stronger than that for individuals — indeed, this was the case at its IPO. David Sacks wrote a fantastic piece this week on how important it is to parse out individuals vs. teams when evaluating SaaS companies.

Compare the valuation multiples to its faster-growing and better-dollar-retention peers and the gap is astonishing. A great resource for comparing Dropbox and other public companies’ metrics is the Meritech Insights page. As the chart below shows, Dropbox has the lowest enterprise value multiple on next twelve months revenue of any SaaS company tracked in the dataset.

Dropbox feels like an ideal acquisition for a company with enterprise distribution that wants more consumer-grade product DNA, needs to evolve with the times for the consumerization of enterprise, has strong net revenue retention, and can slide Dropbox into that machine, picking it up for a decent premium but still well under most SaaS multiples.

It could make a lot of sense for Amazon, Google, Adobe, Cisco, Oracle, SAP, and Zoom to go after Dropbox, not to mention Microsoft and Salesforce themselves. Perhaps with anti-trust scrutiny on several of these companies, the door is open for Adobe, Cisco, Oracle, SAP, and Zoom to be aggressive here, just as Salesforce was with Slack.

To be clear, acquiring Dropbox would be a very different thesis to acquiring Slack. The acquirer would not be paying for growth, net revenue retention, and a product roadmap with significant promise. Instead, the acquirer would be paying for scale, profitability, consumer DNA, and a very strategic place in the stack — the way many people store and manage their files. The commonality between Dropbox and Slack are the network effects inherent in each product, and their ties into the ongoing consumerization of enterprise software.

Finally, Dropbox should be open to selling. If they don’t get their act together on enterprise distribution and on product, they will lag their peers for a long time given the lack of growth and the poor retention. The risk is that they don’t have a buyer for these two reasons, but the thesis for an acquisition is that Dropbox is a story of poor execution and could be so much more interesting as a business with the right parent company, as well as a cash generator for it.

I should note that none of this analysis is based on any insider knowledge. I’m a holder* of Dropbox and Slack stock, as well as several other companies’ mentioned. This prediction is purely speculation, so please don’t take it as investment advice :).

I started next big thing to share unfiltered thoughts. I’d love your feedback, questions, and comments!

*for a list of companies I'm affiliated with as an investor, see my Substack about page.

👇🏽 please hit the ♥️ button below if you enjoyed this essay.

I like the thoughts on possibilities and trends based in the realities of current life. As a long-time educator and now an educator-consultant working with diverse communities, I have a genuine appreciation for insights that inform the practices, organization, and leadership that these trends will expect regarding K-12 learning in publically-funded schools. Suggestions on critical skills students will need to navigate these trends and the ‘delievery’ system envisioned to prepare our youth for this would be very helpful insights. Thanks for a provocative look into the near future.

Travel was left out. Particularly interested since I am a travel writer.