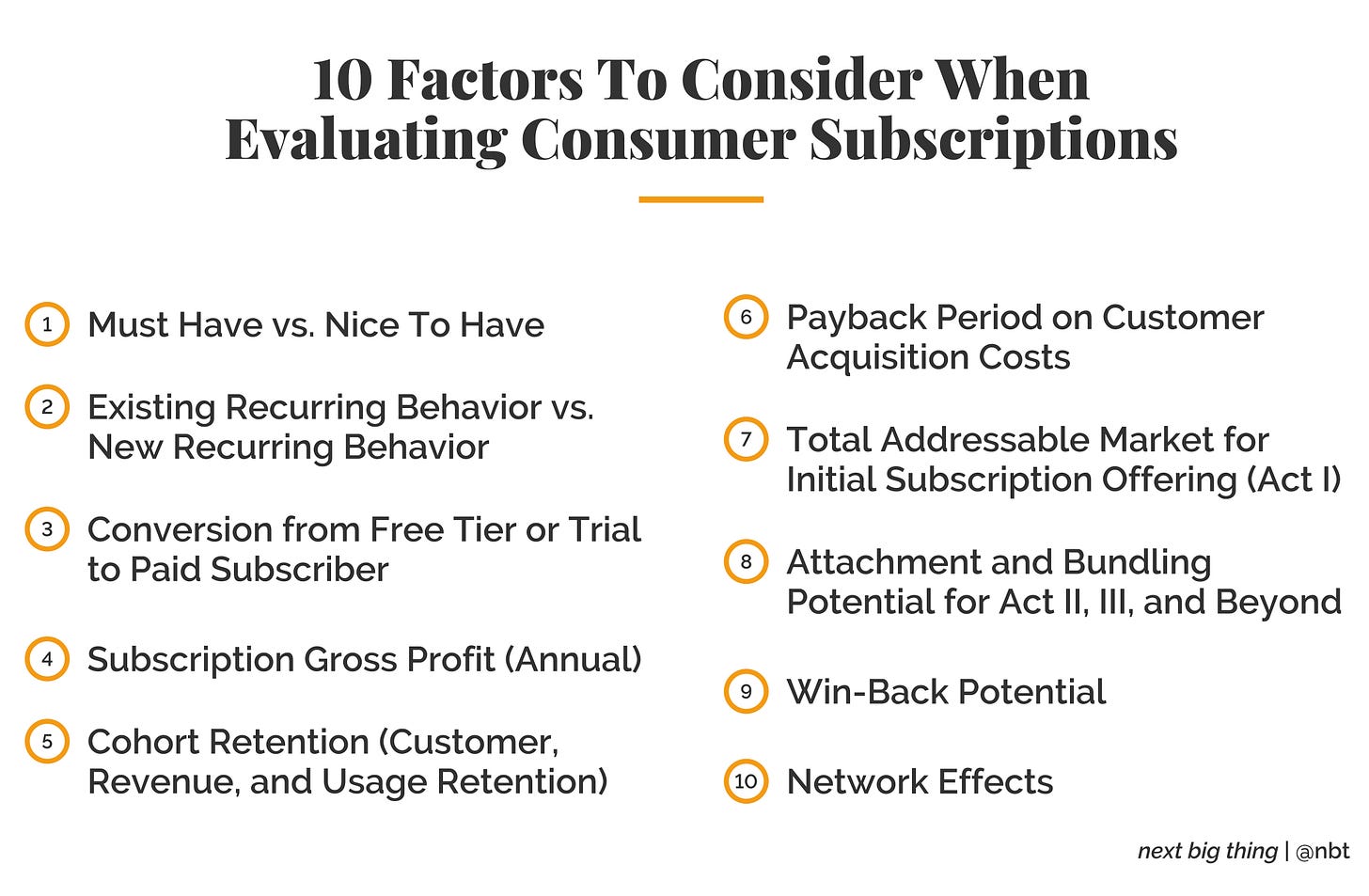

10 Factors To Consider When Evaluating Consumer Subscriptions

All Subscriptions Are Not Created Equal

Welcome to issue #19 of next big thing.

This is the second essay in a three-part series on consumer subscriptions. You can find part one and part three at these links.

One of my all-time favorite blog posts by a venture capitalist is this one on marketplaces by Bill Gurley. He describes 10 factors to consider when evaluating the potential success of a new digital marketplace opportunity. It’s a canonical essay, and one that I’ve referred back to often in the past eight years.

I’ve long wanted to write a similar post, but for subscription businesses instead of marketplaces. This is my attempt: 10 factors that anyone building or analyzing a consumer subscription business can benefit from understanding in more depth.

From Canva and ClassDojo to Imperfect Foods, Literati, Pill Club, and The Farmer’s Dog, I’ve been an early and front-row investor in a collective consumer subscription portfolio that has grown from zero to over $1 billion in annual subscription revenue in the past six years.

While I don’t believe there’s a one-size-fits-all playbook to follow for building great consumer subscription businesses, several factors are important in separating the great ones from the merely good.

Here is a list of ten factors to prioritize when evaluating these companies as investments, and when building consumer subscription businesses as a leader:

1. Must Have vs. Nice To Have

A fundamental question for any business is whether the product or service offered is a must have or a nice to have, a painkiller or a vitamin. But this is particularly important for subscription businesses, where the question of whether a service is a must have is under the microscope, given that consumers vote with their feet to either churn or continue their subscriptions every month, quarter, or year. When the customer’s budget tightens, will the subscription be an easy one to stop because it’s a nice to have? To be a must have, the product or service solves a real need for the customers, and delivers a solution with higher convenience, better cost, or higher quality than other options, and often with a combination of those elements. Necessities such as food, housing, health, and communication are easier categories in which to build must have subscriptions than luxuries such as jewelry, high-end apparel, and more. The best subscriptions provide products and services that are must haves for consumers.

2. Existing Recurring Behavior vs. New Recurring Behavior

It’s much easier to build a subscription business that draws on an existing recurring consumer behavior, instead of trying to create a new recurring behavior. As a result, some categories of consumer spend just lend themselves more naturally to a subscription business than others. Take the grocery category, for instance. Most people buy groceries on a regular basis - perhaps multiples times per week, or once a week, or one or two times per month. Or the pet category, where dogs, for example, will eat the same food, have the same needs (such as walks!), every day for their whole lives. By contrast, it would be hard to build a subscription business in a category such as weddings, which most people do once in their lives. Combine factors 1 and 2, and you have a simple recipe for a great consumer subscription business: a must have service tapping into an existing recurring behavior.

3. Conversion from Free Tier or Trial to Paid Subscriber

Many subscription businesses offer a free tier, or a free or paid trial, to enable consumers to try out the experience before becoming a paid subscriber. A critical factor for subscriptions therefore becomes the conversion rate from the free tier or trial to paid customer; the higher the conversion rate, and the faster the duration of conversion, the more effective the free tier or trial. I’ve seen great subscription businesses have anywhere from a 10% to a 90%+ conversion rate from free to paid. Netflix’s* conversion rate is best-in-class at an astounding 93%, Amazon* Prime Video’s is 73%, and Spotify’s* is 46%. The broader the top of funnel that tries out the service, and the better the conversion rate, the better the subscription business.

4. Subscription Gross Profit (Annual)

There are several top-line factors that matter for a subscription business - pricing to the consumer, gross profit margins for the business, frequency of subscription, and annual membership fees in addition to ongoing recurring subscription fees. But if I have to boil all of these down to one key metric that every subscription business should pay attention to it is the annual gross profit value of a subscriber. To calculate the annual subscription gross profit, take the annual revenue per subscriber and subtract the cost of goods sold (COGS). If the average monthly subscription for the business is $10 per month, for example, with $5 in monthly COGS, the annual subscription gross profit is $60.

This key metric puts digital subscriptions, physical subscriptions, and subscriptions with varying degrees of marginal cost, on a level playing field. As a subscription business works to improve margins, frequency of purchase, the mix of annual vs. quarterly vs. monthly subscribers, pricing tiers, basket size increases, and more over time, this north star metric of annual subscription gross profit can serve as a guiding light.

One further reason to look at this metric is to use it as a benchmark to guide valuation, and what it takes for a consumer subscription business to become a large independent company. For example, Netflix trades at a 28x multiple of its last twelve months’ gross profit today, and Spotify at a 24x multiple. If we assume a lower multiple, 20x, for a more average subscription business than Netflix or Spotify, the business would have to get to $50 million in annual gross profit to be valued at $1 billion or more. 1 million subscribers at $50 in annual subscription gross profit, or 250,000 subscribers at $200 in annual subscription gross profit, are two ways to get to $50 million in annual gross profit. These are two very different paths and business profiles to build a billion-dollar company. Netflix’s annual gross profit per subscriber is just under $50, as one benchmark.

5. Cohort Retention (Customer, Revenue, and Usage Retention)

I’ve publicly stated that the metric I care the most about in subscription businesses is retention. There are three cohort retention graphs that are important to study. The first is customer retention, which shows the % of customers that remain subscribers in every cohort. The second is revenue retention, which shows the % of revenue in each cohort that remains the longer the cohort stays active. Ideally, revenue retention should be higher than customer retention, because subscribers that stick around are able to spend more on the subscription over time. Finally, it’s important to closely watch usage retention, which shows the % of customers in each cohort that continue to use the product over time. Usage retention is a leading indicator for customer retention; if the usage is low for an annual subscription, for instance, it is likely that the churn for that subscription will be high at year 1, even if there isn’t data yet on annual renewals. Though some businesses, such as gym memberships, have lower usage retention than customer retention, and yet stay viable because they are aspirational for customers, the best subscription businesses have strong retention across all three of these dimensions.

As for benchmarks for what these %s should look like for a great subscription business, Lenny Rachitsky has an awesome post - What is good retention - based on experts’ experience and data gathered from companies. Great user retention at month 6 is above 50%, and great revenue retention at month 12 is above 80%. Lenny also has an excellent post on how to increase retention. I wrote a post a few years back about Dollar Shave Club’s* retention, and may write a future essay where I dive in further to benchmarks for this and other key consumer subscription metrics.

One final point on retention. What is most important when analyzing cohorts is not the raw % of subscribers at month 6 or month 12 or month 24, but rather the slope of the curve in those outer months. The flatter and more asymptotic the curve, the better the subscription business. And conversely, if the cohort retention curves do not asymptote, the business will have significant challenges at scale with customer churn. Eric Stromberg has a screenshot essay that illustrates this point well.

6. Payback Period on Customer Acquisition Costs

When looking at a subscription business’s capital efficiency, as well as its ability to grow, the most important metric is payback period. The best subscription businesses have very quick payback on customer acquisition costs, perhaps even instant payback. This is especially true for those businesses that utilize annual or longer duration pricing plans to sign up subscribers. By contrast, a payback period of over a year is challenging for most consumer subscription businesses. Even those with strong cohort retention will take significant capital on customer acquisition to get to scale. One great piece about payback is this one by Talia Goldberg, which defines Payback Ratio as an important benchmark she looks at.

Is the raw customer acquisition cost (CAC) important to track? Of course. The more word-of-mouth that drives your customer acquisition, the lower the blended CAC and the stronger the business. Is the ratio of lifetime value to CAC (LTV/CAC) a north star metric that a lot of businesses are judged on? Yes. But the combination of the above 4 factors (payback period, cohort retention, subscription gross profit, and conversion rate) are all inputs to LTV/CAC. In my opinion they are all more important independent metrics to pay attention to for a subscription business than the singular metric of LTV/CAC, particularly for early-stage businesses where data is limited and thus LTV/CAC may be hard to extrapolate.

7. Total Addressable Market for Initial Subscription Offering (Act I)

Some great subscription businesses start in a small market that they can dominate, and others start in a big market where getting to a fraction of market share can still build a meaningful business. Either way, it’s important to understand the total addressable market for the initial subscription offering, or the Act I, as I like to refer to it. When investing in businesses at the early-stage, you may have early visibility into how the Act I is progressing. One question I ask myself: does the addressable market for the Act I support a business that could do over $50 million in annual subscription gross profit, and therefore be valued at over $1 billion? Putting everything else aside, believing in the Act I, and that the Act I can lead to a big enough business is an important criteria in evaluating any consumer subscription company.

8. Attachment and Bundling Potential for Act II, III, and Beyond

Most great subscription companies have an Act I that gets them to tens or hundreds of millions, or even billions, of dollars in revenue. But they follow that up with more products and services that lead to secondary and tertiary subscription offerings (Act IIs and Act IIIs) that expand the size of the business and the total addressable market. At the early-stage, it’s important to consider the vision for Act II, and the potential for subscribers of Act I to attach themselves to Act II once it is launched.

As one example, consider Dollar Shave Club. Its Act I was a simple service to subscribe to razors and razor blades (the most affordable tier at $1 per month!). Its initial marketing launch through the now-famous video was all geared around this Act I. Just over a year later, Dollar Shave Club launched Act II, wipes, and today offers many products across skin care, shaving, and other categories geared towards men’s personal care.

Another consideration as you think about the vision for the subscription business, beyond attachment potential, is bundling potential. A bundle is a service that includes multiple products and services that may be quite different and even from different providers in one package. Some of the most powerful subscription businesses, such as Amazon Prime, are bundles. Two great resources to further understand bundling are Ben Thompson’s several essays on the subject, and Shishir Mehrotra’s piece on the four myths of bundling.

9. Win-Back Potential

When a subscription business starts to get to scale, one often-overlooked factor is win-back or resurrection potential. How can the company turn previously churned subscribers into paid subscribers again? For some businesses, an important component of this answer is a free tier that enables customers to continue to see value out of the service, and to be engaged to convert back to being a paid subscriber over time. Another component of win-back potential is improving the core product or service, either by increasing its quality, improving the convenience of the offering, or by lowering its price. Finally, there are some subscriptions that are more episodic or seasonal in nature. Take the dating category, where there are several great consumer subscription businesses. These businesses do suffer from higher churn than the average consumer subscription, but they also have higher win-back because people naturally go in and out of dating. Win-back potential can compensate for lower short-term cohort retention to still enable a large subscription business to be built.

10. Network Effects

Finally, a pushback I’ve received to some of the consumer subscription investments I’ve considered over the years is that, unlike social networks or marketplace businesses, these companies do not benefit from network effects. This suggestion is simply untrue. In fact, the best consumer subscription businesses leverage network effects to increase the value of the subscription offering, to boost many of the factors listed above, and to provide a moat against competition.

Netflix and Stitch Fix are examples of subscription businesses that leverage data science to improve the product over time. Data network effects enable the service to become more of a must have, and can expand the addressable market. Peloton is an example of a consumer subscription business that has social network effects. With each new Peloton customer, the community grows. Being able to do workouts with friends is an important motivator for continuing to use and enjoy the product, and makes Peloton more of a must have. For more on network effects, NFX has published a lot of great work, such as this piece laying out the different types of network effects. Both physical and digital subscription businesses can leverage network effects, and the ones that do will build larger, more defensible, and more enduring companies.

I hope these 10 factors help you better evaluate consumer subscription businesses going forward. In the next piece, the third and final part of this series, I will analyze one of the consumer subscription investments I’ve made across these 10 factors. Please subscribe (for free!) if you’d like to make sure you receive that, as well as all subsequent essays, directly in your inbox.

Thank you to Ajay Arora, Angela Tran, Brett Bivens, Jeremy Gurewitz, Lenny Rachitsky, Nico Wittenborn, Philip Behn, Sam Chaudhary, Sriram Krishnan, and Talia Goldberg for your feedback on the draft.

I started next big thing to share unfiltered thoughts. I’d love your feedback, questions, and comments!

*for a list of companies I'm affiliated with as an investor, see my Substack about page.

How do you think lightweight consumer software products like Duolingo and Grammarly fit into this framework? They feel decidedly "nice to have" and don't really have strong/unique business models behind them -- and yet they've created a ton of value for consumers and investors. Do you think there is another vector of consideration around the ability to amass a unique data asset through consumer usage?

Hi Nikhil, just wanted to say thank you for this fantastic write up! I found it to be both enlightening and well written. Take care.