Venture Partnerships vs. Solo Capitalists

The best partnerships can win in the long run, but the bar has been raised.

Welcome to issue #26 of next big thing.

Two interesting articles that tie into themes I’ve discussed in this newsletter.

First, The New York Times Magazine published a great long read last week — Can Shopify Compete With Amazon Without Becoming Amazon? — and the author, Yiren Lu, interviewed me for it. It ties in nicely to Shopify and The Key Decision for Business-in-a-Box Platforms (#7).

Second, Eric Newcomer wrote a piece this week — After the Fallout: Silicon Valley consumer investing is back after a nuclear winter — that very much relates to last week’s Consumer Technology is Alive and Well (#25).

My plan for December is to do a series of follow-ups to popular essays I wrote this year. Let’s see if I can pull this off without any new ideas or news distracting me 😉.

Today’s essay is a follow-up to The Rise of the Solo Capitalists (#9) and a brief return for me to the subject of the venture capital industry.

There’s been considerable activity from solo capitalists in the fundraising landscape in the five months since that piece, and continued chatter about their place in the ecosystem.

But what I neglected to dive into in the original essay were the advantages and disadvantages of being in a partnership versus being solo. I’ve been reflecting on this topic over the past few months, and thought I’d share my learnings with you.

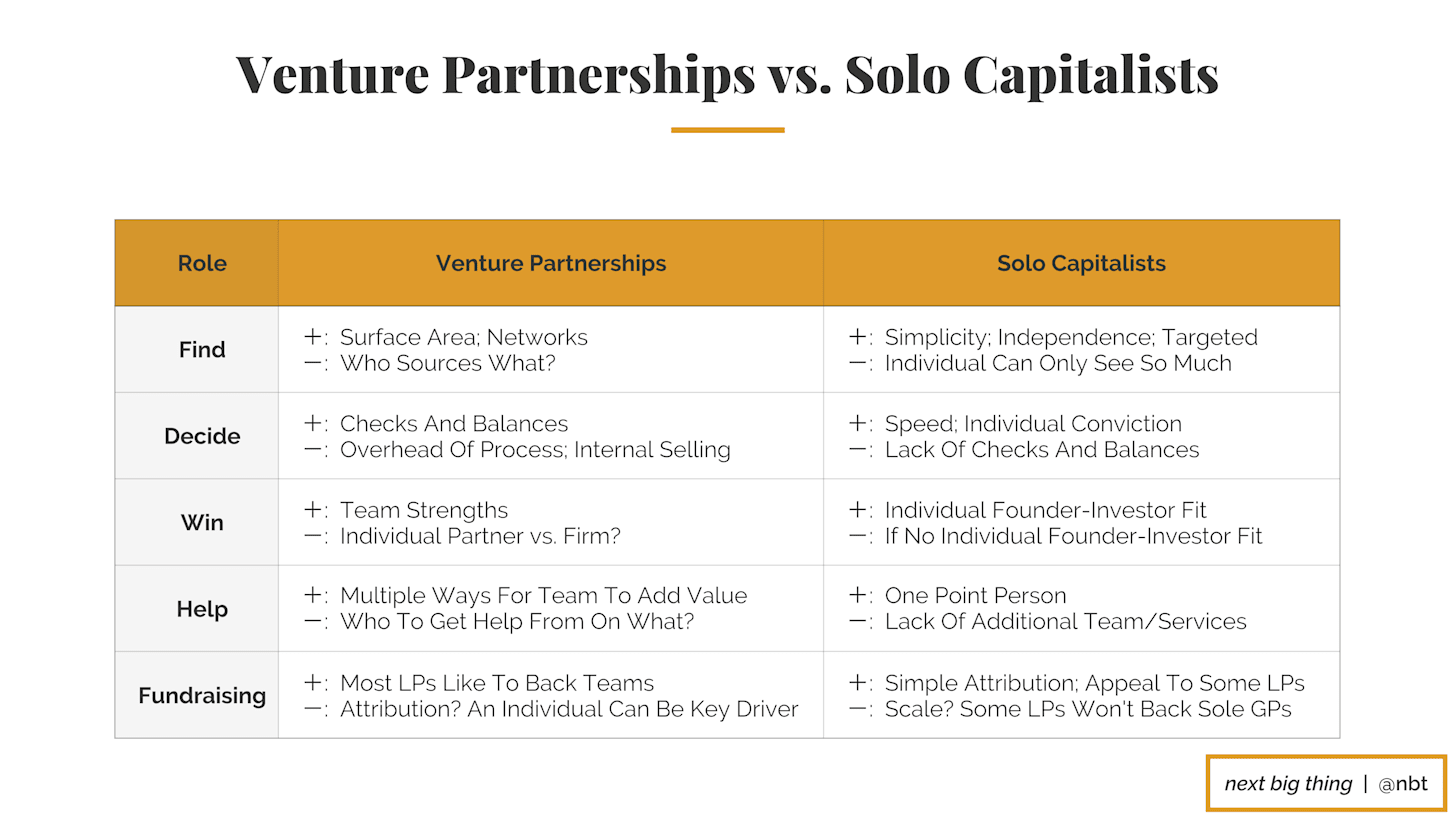

Tradeoffs Of Each Model

The framework I return to when analyzing the venture capital industry is The Venture Capital Flowchart (#12): Find, Decide, Win, Help, Exit. To study differences between solo capitalists and traditional venture partnerships, it’s also important to think about Fundraising, the process by which VCs raise capital from limited partners (LPs).

Find

The advantages that partnerships have in sourcing companies is greater surface area. More partners means more networks to find founders to invest in, and more feet on the street for both proactive and reactive sourcing. The disadvantages, however, can be confusion to founders. Who in the partnership should we be talking to? Who understands our business best, or more importantly, who has the clout to push this investment through? Different partners having their own swim lanes can lead to some companies not finding the right “fit” within the partnership to look at their company.

For solo capitalists, sourcing advantages include being able to target specific networks of people that they know well, true independence, and making it simple for entrepreneurs to know who to go to (only one!). The disadvantages, of course, are the lack of ability for a solo capitalist to “see everything” — there’s only a finite amount of capacity for each individual to spend time meeting new potential investments.

Decide

Most partnerships operate with checks and balances in decision-making. Multiple partners need to get excited about an opportunity to approve a significant investment. On the one hand, this can lead to better decision-making, as partners push one another on their judgment and level of conviction. On the other, more steps in the process, such as more partners for founders to meet, can lead to more inefficiency and a slower decision. And partnerships can also suffer from groupthink and an internal selling process that clouds judgment.

One of the core advantages for solo capitalists is the speed with which they can make investment decisions. This can be a blessing — founders often react positively to fast, conviction-driven decisions. But the disadvantage can be the lack of checks and balances on investment judgment. Solo capitalists can call other investors to see what they think of an opportunity, but there’s no substitute for a truly incentivized partner to give honest investment feedback.

Win

Winning the right to invest comes down to Founder-Investor Fit (#11). For solo capitalists, this comes down to the fit between the individual investor and the founders. For partnerships, advantages in winning include the ability to mobilize the partnership as a team and show founders all the ways in which the firm can add value to help win over founders. But the disadvantages can be the relationship between the individual partner sponsoring the investment and the firm. A founder may be excited to work with the firm but not as excited about the individual, and vice versa. More on what founders want below.

Help

A core advantage for venture partnerships is that they can offer services, such as help with recruiting, as well as multiple superpowers within the investment team, to help portfolio companies. However, a disadvantage is once again potential confusion on who within a partnership to go to for what type of help. For solo capitalists, the advantage here is the simplicity of one point person to work with every portfolio company. But the disadvantage is the constraints on that individual’s time, once again, and the lack of value add services around them. One way to mitigate this for solo capitalists is to include others in a financing round’s syndicate that can add value in different ways to the founders.

Fundraising

The traditional group of LPs in venture capital includes corporations, endowments, family offices, foundations, funds of funds, and pension funds. A core advantage for partnerships is that it’s a traditional model and better understood by LPs, although disadvantages can stem from attribution on investments. Oftentimes, there’s a single individual in the partnership that is the driver of a lot of returns, and that can lead to fundraising and the firm’s future falling on one individual’s shoulders.

While solo capitalists face the disadvantage that some LPs simply won’t invest in sole GP funds, and that it is much more difficult for them to scale than for a partnership, an advantage is that attribution isn’t even a question in the fundraising conversation. There are also more LPs that are willing to take a bet on solo capitalists than ever before, which is part of what’s enabled their rise. And finally, there’s a class of LPs that like to invest deal-by-deal, through special purpose vehicles (SPVs), and directly in companies. Solo capitalists often afford those LPs these opportunities in a greater way than venture partnerships, given they lack the scale in capital base as, say, the agglomerator firms have.

What Do Founders Want?

While the above are all important points for venture capitalists and LPs to consider as they think about their firms and the competitive landscape, what really matters in our ecosystem is what founders want from their capital partners.

I discussed the bifurcation of venture capital firms in Agglomerators vs. Specialists (#10). Some founders prefer working with agglomerator firms — which solo capitalists can’t be — while others prefer specialists — of which solo capitalists are one distinct option.

Some founders prefer the idea of working with a team as their lead investor, while others prefer the idea of working with an individual.

Some founders want help from their investors, while others prefer to be left as autonomous as possible.

What most founders do want is a signal from their investors that the company is of high quality. What is increasingly true, as I discussed in the original piece on solo capitalists, is that it’s often the individual investor, and not the firm, that creates signal in the market on the quality of the investment. There are only a handful of firms that have brands such that the firm itself is a signal in spite of who the individual partner leading the investment is.

I do believe the individual partner matters more than ever to founders, and will continue to matter more than the firm in the coming decades. And that means that the bar for a partnership to win over founders has increased, especially so due to the rise of solo capitalists as a financing option for founders.

The Best Partnerships Can Win

My original piece was not intended to be an advertisement for solo capitalists, though it perhaps may have become one. It was merely pointing out a fascinating trend in the industry that I and others had observed.

So what do I believe the future holds for venture partnerships vs. solo capitalists?

I believe solo capitalists are here to stay. They are finding founder-investor fit with a number of entrepreneurs, and leading competitive financing rounds. They’re an interesting option for founders, and an exciting career path for investors at any stage.

But I do also believe that the best partnerships have advantages that enable them to out-perform on all aspects of the venture capital model over a long period of time.

What matters most for a partnership is the strength of the partnership itself. A group that’s aligned on principles and values, but complementary in skills and experiences can be a great partnership. When each partner has an individual brand, has distinct superpowers, pulls her or his weight equally, and reinforces the brand and superpowers of the firm as a result, the partnership has a chance to outcompete even the best solo capitalists. In her post In praise of VC partnerships, VC Check Warner gives a number of personal examples for why partnerships can be so valuable.

Partnerships that don’t fit the above characteristics are in trouble. Some will unbundle, with perhaps a few solo capitalists branching out from them. Others will simply fall into irrelevance as they are out-competed by better partnerships and by solo capitalists to win over the best founders.

And partnerships that do have alignment, complementary skills, and a whole that is greater than the sum of their part(ner)s, can endure. Those firms’ brands can grow, and see their competitive advantage compound over time. As LP Craig Thomas writes, “brand is arguably the only thing that resembles a moat in traditional venture capital.” My bet in the coming decades is on the next great partnership building that brand.

Thank you to an anonymous LP for your feedback on the draft.

Great piece. One aspect of this topic that I would have loved to get your take on is the difference between the two in terms of accrual of structural advantage over time and how much of that is due to institutionalism of the firm that typically comes from long-term partnerships.

In fact, I'd argue that's one reason some LPs prefer to invest in GP partnerships rather than solo GPs.

Awesome post Nikhil! I agree it's about identifying your model's strengths and weaknesses and then playing your strengths very hard!