Consumer Technology Is Alive and Well

Five reasons for why consumer doesn't need a platform shift to thrive in the 2020s.

Welcome to issue #25 of next big thing.

The string of IPO filings last week from consumer technology companies — Affirm, Airbnb, DoorDash, Roblox, and Wish — got me thinking about a question I’ve fielded frequently over the past five years:

“Isn’t consumer dead?”

The premise of this line of questioning is that consumer investing and consumer technology entrepreneurship is hard, with major platform companies already built and not much room left for innovation. When incumbents such as Amazon*, Apple*, Facebook* and Google*, are so large and nimble, do startups stand a chance to build huge businesses? Since the last major consumer platform shift was the rise of the smartphone, and that technology trend is now a decade old, where are the opportunities going to be moving forward? And how do consumer startups get distribution? Isn’t building a big consumer technology business much tougher than doing so in enterprise software? At the start of the pandemic, the latest worry was “aren’t consumer tech businesses going to be crushed by covid-19?”

My belief is that the answer to all of these questions is that consumer technology is alive and well, and the past week has given further credence to this answer. Here are five reasons for why the 2020s will be an incredible decade for consumer businesses:

Large categories of consumer spend need reinvention through technology.

Behavior shifts are driving the adoption of new products and services.

Covid-19 has been an accelerant for consumer technology startups.

Consumer and enterprise are increasingly blurring together.

There are massive recent success stories that illustrate the above four points.

Large Categories Of Consumer Spend

A core theme of this newsletter is that there are many markets in which the next big thing can be built.

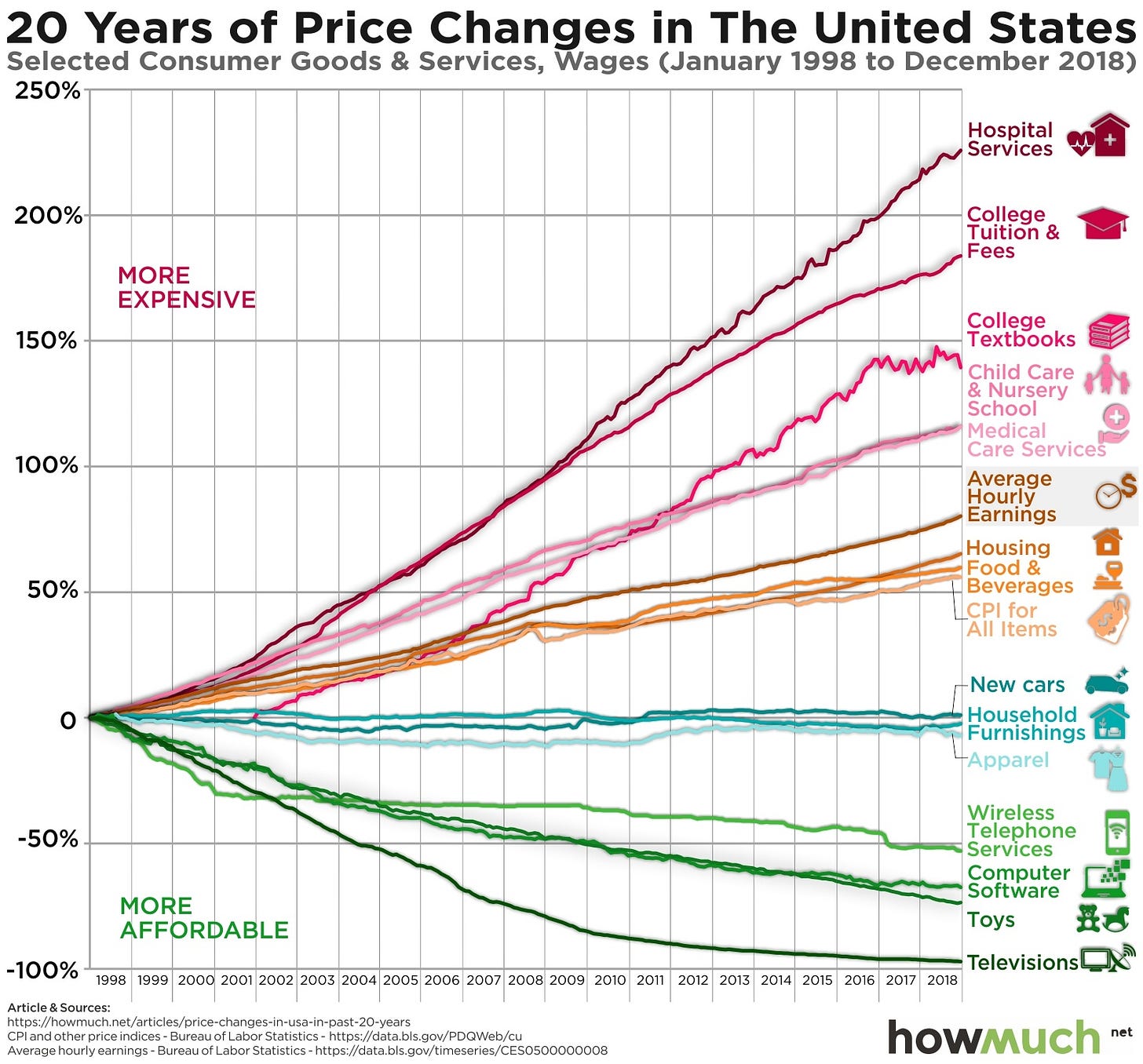

In Democratizing Access (#22), I touched on several companies across categories such as education, financial services, healthcare, and transportation that are enabling consumers to have access to products for free, cheaper, or more conveniently than legacy alternatives.

In The Consumerization of Healthcare (#21), I dove into healthcare in particular, and how this massive category of spend is being reinvented through consumer technology, and thankfully so, given the poor quality of the healthcare experience for many, as well as the rise in costs.

A good place to start to think about which consumer categories are most desperately in need of innovation is the chart below, which shows which goods and services have increased and decreased the most in price over the last 20 years.

Behavior Shifts Drive Adoption

Consumer behaviors and priorities are constantly changing, and this leads to constant new opportunities for startups.

The story of so many great new consumer technology businesses has been tapping into an existing consumer behavior and enabling it to become more mainstream; for example, Uber* and Lyft* enabled ride hailing using the smartphone, and dramatically expanded the market as a result of creating a magical experience.

As I discussed in Consumer Subscriptions (#18), consumers’ comfort with the subscription business model has unlocked new business opportunities across all areas of consumer spend. The Climate Crisis (#16) and The Mental Health Crisis (#17) are two examples of challenges that have steadily increased in consumer consciousness, and I believe are more ripe than ever for new startups to tackle as a result. Food Delivery (#13) and Grocery Delivery (#15) are categories that have existed for a while, and yet consumers’ interest in these behaviors has grown and grown, leading to new companies like DoorDash and Instacart scaling dramatically in the past few years, despite there being prior successes such as GrubHub and larger capitalized players like Amazon in these categories.

Even in social networks and communication products, a seemingly very saturated field, consumer are open to trying something new and making it a habit. The rise of social platforms like TikTok, Roblox, and Discord in the recent past, despite Facebook and Snap’s* dominance in social, are examples of this phenomenon.

As my friend and fellow venture capitalist Rebecca Kaden said to me this week:

Consumer behavior is never done or satisfied. One of the great things about brands is that magical products or platforms or experiences can delight customers in new ways and create new categories or behavior shifts. This is hard but history shows us it happens repeatedly so buckets are never finished.

COVID-19 Is An Accelerant

Last week, I wrote about The Most Obvious Consumer Hardware + Software Opportunity Today (#24): a high quality, easy-to-use, integrated hardware and software videoconferencing system to democratize access to professional-looking video calls. This wasn’t an obvious opportunity a year ago, but is today, due to the increase in remote work and work-from-home. And that, of course, is due to the pandemic we’ve been in for the majority of 2020.

Covid-19 has led to several consumer behavior changes. For example, eCommerce has increased dramatically, and is forecasted to be over 10% higher as a percentage of total retail in a decade than forecasts prior to the pandemic. While it remains to be seen how many of these shifts are permanent, my belief is that many of them will be, particularly in sectors such as education, healthcare, local retail, restaurants, travel, and others that have been more heavily impacted by covid-19 than others.

Consumer And Enterprise

Back in May, I wrote in Consumer and Enterprise (#2) about how the most interesting companies in the world fit neither bucket: they are both consumer and enterprise technology businesses. With the lines blurring between the two, it’s impossible to ignore consumer technology, even as an enterprise-focused builder or investor.

Take two companies that have gone public this year, Asana and One Medical, as examples. One Medical targets both consumers and enterprises (employers) as customers, with an integrated healthcare experience offered to both. Asana’s software enables teams to work together. From the company’s S-1:

“Enterprise users” are just consumer users—or, as we like to call them, “people”—at work, with the same desire and appreciation for high-quality design and delightful interactive experiences. We want our customers to love the product we’ve built and to feel more connected to their teammates and their organization’s mission by using it. This is why we’ve set out to design and build products that rival the best consumer software.

Asana’s founders were previously at Facebook, and have built an enterprise software company in which consumer DNA and technology has been core to its success.

Massive Success Stories

The four reasons above bring me back to the five IPO filings from the past week.

Affirm is a financial technology company that enables consumers to buy products and pay later through a payment plan. It is driving new consumer purchasing behaviors at point-of-sale and is both a consumer and enterprise company, highlighted in its vision:

To be as ubiquitous, secure, and convenient as legacy networks, yet far more transparent, honest, and both consumer and merchant-centric.

Airbnb is an online marketplace and hospitality company, enabling consumers to stay in properties around the world. Travel is a large category of consumer spend that Airbnb has reinvented, and, while covid-19 has negatively affected the travel industry, the business has shown its resilience versus that of hotels. People’s desire to stay for longer terms, to do staycations instead of trips with long flights, and more, has led to the adoption of Airbnb in a way few predicted a decade ago.

DoorDash is a three-sided marketplace with consumers and enterprises - users ordering food delivery, restaurants that accept orders, and dashers who deliver the food. Covid-19 has certainly accelerated the business.

Roblox is a gaming, developer, and community platform with over 30 million daily active users. Not only has it built a highly engaged and fast growing social network in the age of Facebook and others, but it’s also enabled users to become businesses generating millions in annual revenue through building games on the platform.

Wish is a mobile commerce company. While covid-19 has positively and negatively impacted the short-term business, the long-term acceleration in eCommerce stands to benefit the company, as well as the increasing consumer comfort to shop on mobile.

These success stories are different from the consumer successes of the prior decade. Ben Thompson provides an astute framing of this in a piece from last week, Playing on Hard Mode. He compares Facebook’s success as “playing on easy mode,” versus the journeys of Airbnb and DoorDash in particular:

What both companies represent, though, is what it means to play on hard mode. Neither lodging nor logistics is inherently digital; both companies had to make them so, creating new markets that didn’t previously exist. That both Airbnb and DoorDash have done so to a sufficient degree to go public is not only impressive, but will increasingly be a roadmap for new startups, and a model for how the Internet will transform more and more components of the “real” world.

The last couple of decades have given rise to incredible consumer technology platform companies, such as Amazon, Facebook, and Google. But, while those companies possess tremendous strengths, I couldn’t be more excited about the prospects for new consumer technology companies in the 2020s.

Beyond the above five reasons, there’s also the possibility of new technologies and media that drive enormous opportunity — voice and audio-based social networks; opportunities on top of newly ubiquitous platforms such as Zoom*; artificial intelligence with models such as GPT-3; mainstream adoption of Bitcoin and other cryptocurrencies; CRISPR, mRNA and other advances in biotechnology; the potential of self-driving vehicles; the continued proliferation of space travel, and much more.

The next big thing in consumer may look quite different from, and may be harder to build than that of the prior generation, but opportunities abound. And the past week should serve as a great reminder of that for any remaining skeptics.

Thank you to Rebecca Kaden for your feedback on the draft.

Happy Thanksgiving to all celebrating. I’m very grateful to you for reading, sharing, and responding to my writing.

I started next big thing to share unfiltered thoughts. I’d love your feedback, questions, and comments!

*for a list of companies I'm affiliated with as an investor, see my Substack about page.

Thank you for sharing your thoughts on consumer technology. The future for consumer tech does seem optimistic. However, it is also going to be rewarding only for those with companies that innovate on a totally different level. With a lot of new startups in the consumer technology space, it will be interesting what a company did to get through the 2020s successfully. Would it be creating new markets like Airbnb and Uber did? Or would it be about tapping into behavior patterns the way TikTok did? Or would it be a combination of all the known strategies? I hope to see more companies utilizing persuasive technology to empower individuals, solve social issues like hunger or, find a way to work together to slowing down climate change.

well written Nikhil! I couldn't agree more